Needless to say, that Bitcoin remains the most significant, costliest and oldest digital coin in the world. It has been making headlines in the media for the past few years. However, the year 2021 belongs to Bitcoin. All thanks to the surge it has witnessed in 2021. Despite the issues like the vast requirement of power and volatility, one can still find the future of this coin intact. 2021 has proven to be a year with all records coming under Bitcoin. It has remained the breaking news all these months in 2021. As we see the digital currency-based assets reaching the next level in the new market, one can find the market capitalization now reaching a record of around 3 trillion USD. One can find the market cap for the coin reaching 2 trillion in just four months from Jan 21, when it was recorded as 1 trillion USD. We now hear that the coin is scoring all the points with us.

The 1.5 B USD Investment by Elon Musk

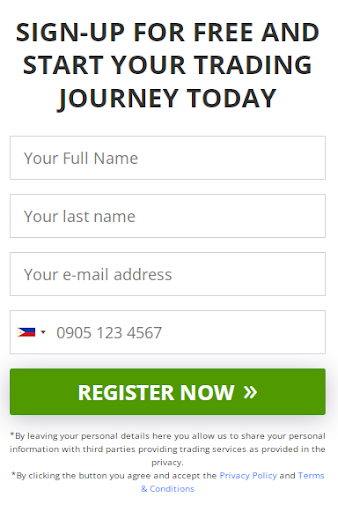

The year got a shock when the Tesla chief Elon Musk came up with this significant investment plan. He invested a whopping 1.5B USD in Bitcoin, breaking all the records in this domain. Thus, one can find the investment coming on a more critical and higher note. Also, the company was seen coming up in alliance with the US-based regulatory body called SEC. Musk was seen filing about his investment with the said agency. He announced that he would now start accepting virtual money like BTC as a payment option for his vehicles. The moment Musk made this announcement, and we saw a quick rise of Bitcoin, reaching the 60K plus amount for the same. Earlier it was only 44k USD. It was the coin’s record as it reached this level for the first time. However, many government agencies added the red flag on Musk’s activities, particularly his words on BTC on social media. They raised a question about how Musk behaved on Twitter’s microblogging site. Click this image below to start your bitcoin journey.

Global Groups Heading to BTC

Once Tesla invested the whopping amount, we see many more players taking a plunge in the crypto domain. Some examples include financial groups like MasterCard that remains the top payment platform in the US. Soon we saw the US-based bank called New York Mellon that came forward to win huge money. They started their venture of validating this coin in a big way. Then came the patent company called Marathon, known to be listed high on Stocks, too joined the bandwagon. The company was seen putting a whopping 150 M USD coins for their treasure on Jan 21. Also, the popular social media platform Twitter founder invested in Bitcoin and promoted the coin in a big way. Thus we saw many more companies like Square and financial companies like JP Morgan and payment platform PayPal invested massive money in Bitcoin. Others include even insurance companies like AXA, and other technology-based companies like We Work also started accepting payment in BTC.

The digital currency clampdown in China

In 2021, we have seen Bitcoin mining take a different turn. China was one of them to go against the tide by clamping down Bitcoin and other coin mining in a big way. In the ninth month of this year, China’s central bank was seen blocking the digital currency based transaction. The country claimed it was an illegal affair and went to ban digital coins. It proved that they are leaving no stone unturned to keep the ball rolling with the cracking down of the industry. To understand the clampdown of crypto, we see China take an instant timeline of different events.

Regulators Bring Bitcoin on their radar.

Several globally acclaimed regulators claimed that Bitcoin and other digital coins need regulations. China was the first nation to declare Bitcoin illegal, while other nations like Algeria, Iraq, and Egypt were also seen walking on the same road as China. They have put their financial consultants on the job, asking them to analyze the market and the trade surrounding these coins this year. However, these nations have remained frenzy at the moment as far as Bitcoin and other digital currencies are concerned.

Leave a Reply