Altcoin pump-and-dump schemes are a growing problem in the cryptocurrency market, causing significant losses for investors and eroding trust in the industry as a whole. In this expert article, we’ll explore the mechanics of these schemes, the risks associated with investing in them, and the strategies for protecting yourself from them. Understanding cryptocurrencies as their popularity grows is crucial for individuals and businesses alike.

The Mechanics of Altcoin Pump-and-Dump Schemes

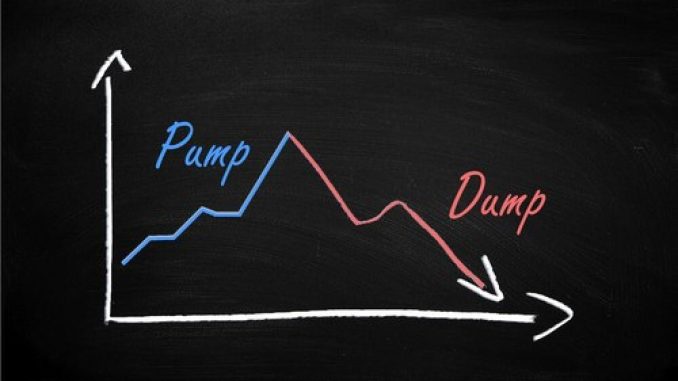

Altcoin pump-and-dump schemes are a type of market manipulation that targets low-cap, low-liquidity cryptocurrencies that are easier to manipulate than mainstream coins like Bitcoin or Ethereum. The goal of a pump-and-dump scheme is to artificially inflate the price of a targeted coin by spreading hype, false rumors, and social media campaigns that lure in unsuspecting investors who believe they are getting in on the ground floor of the next big thing.

The mechanics of a pump-and-dump scheme usually involve a group of insiders who coordinate their buying and selling of the target coin to create a buzz and trigger a buying frenzy among retail investors. This can be done through private messaging, chat rooms, or other social media channels that are not publicly accessible.

Altcoins that are most susceptible to pump-and-dump schemes typically share certain characteristics such as low market capitalization, thin order books, and low trading volumes. These factors make it easier for a small group of manipulators to control the market and create artificial demand. Additionally, many of these altcoins lack a clear use case, technical innovation, or a strong community, which makes them more vulnerable to hype and speculation.

Some of the warning signs that a coin is being targeted by a pump-and-dump scheme include sudden price spikes, massive buying volumes, and a surge in social media activity. However, these signals can be misleading or manipulated, and many investors fall prey to the FOMO (fear of missing out) effect that drives them to buy into the hype without doing their due diligence.

The impact of altcoin pump-and-dump schemes can be devastating for the affected investors, who can lose all their money in a matter of hours or even minutes. Moreover, these schemes erode the trust and credibility of the cryptocurrency market as a whole, and make it harder for legitimate projects to gain traction and funding.

The Risks of Investing in Altcoin Pump-and-Dump Schemes

Altcoin pump-and-dump schemes are not only illegal but also pose significant risks to investors. First and foremost, these schemes are designed to deceive investors by artificially inflating the price of a coin beyond its fundamental value, leading to a rapid and significant price drop once the insiders sell their holdings.

Another risk associated with investing in pump-and-dump schemes is the potential legal and ethical consequences. Regulators are increasingly cracking down on these schemes, and investors who participate in them may face fines, legal action, and reputational damage. Additionally, investors who knowingly participate in a pump-and-dump scheme may be liable for fraud or market manipulation charges.

One of the challenges of avoiding pump-and-dump schemes is that they often use FOMO (fear of missing out) and FUD (fear, uncertainty, and doubt) tactics to create hype and deceive investors. FOMO tactics prey on investors’ desire to get in on the ground floor of a promising investment, while FUD tactics spread false rumors and negative news to scare investors away from legitimate projects and towards manipulated coins.

Investors who fall prey to pump-and-dump schemes may also suffer psychological and emotional damage. These schemes often prey on investors’ greed and hope for quick profits, leading them to make impulsive and irrational investment decisions. When these investments inevitably fail, investors may feel embarrassed, angry, or depressed, and may be reluctant to invest again in the future.

To protect themselves from the risks of investing in altcoin pump-and-dump schemes, investors should do their due diligence and research before investing in any cryptocurrency. This includes looking for information on the coin’s development team, use case, community, and market fundamentals. Investors should also diversify their portfolios and avoid putting all their eggs in one basket, as well as monitor the market closely for any signs of manipulation or suspicious activity.

Finally, investors should be aware of the importance of education and awareness in the cryptocurrency field. By staying informed and up-to-date on the latest news and trends, investors can make better-informed decisions and avoid falling prey to scams and fraudulent schemes.

Conclusion

The risks of altcoin pump-and-dump schemes cannot be overstated. These schemes are designed to deceive investors and manipulate the market, causing significant losses and legal and ethical consequences. By understanding the mechanics of these schemes, recognizing the warning signs, and taking steps to protect yourself, you can reduce your risk exposure and make informed investment decisions.

Leave a Reply