Today we have seen good popularity of the digital currency in the market. It is free from any government agency or central bank and remains free from other things. It acts like P2P technology and helps move smoothly with all the critical functions, including issuing currency and processing transactions and even validation. One can find the real secret of the technology very much backing the coins as one can find with the technology often called Blockchain. The said technology has the power of changing the world. Like how we see the web changing the world, Blockchain has similar power and potential to change the world upside down. The technology has gained popularity, and one can see its presence across the domains irrespective of its financial applications. The technology has a simple definition that remains like a distributed and decentralized ledger. These other records are the source of digital coin protection. Now, let us understand how digital coins would be our future money.

Digital Money Vs. Traditional Currency

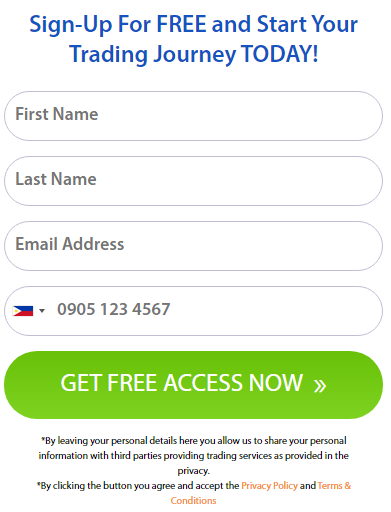

We can call Bitcoin a decentralized and non-governed thing that comes under a central authority. However, it is developed with the help of miners that are seen all over the globe. Thus, the manipulation remains free from any central bank and the law of the land. However, it is developed with a value that depends entirely on how investors go ahead and are keen on paying at any juncture. One can find the credibility and security of Bitcoin in a big way, and it is backed with the above-said technology that remains very much popular all over the world. It is not easy to hack coins with this technology. Bitcoin is developed with the process of mining. It requires robust computer systems to answer complex coins, as seen in 21 million. Click this image below to start your bitcoin journey.

If we consider fiat currency, it is just the opposite. These are developed by central banks that remain the critical authority over these coins and have the government’s interference. Unlike Bitcoin or other digital currencies, it is pitted with several issues. The devaluing of fiat money can lead to issues like a recession. To understand this issue of this coin, you need to check the classic example of China, where we have seen the value of its currency going down and boosting exports in a big way. We have seen the country trying different things to save their currency. They used the idea of exports in the market to keep the market moving ahead fast. Fiat currency is issued with a central body amid the transaction. Many banks regulate the number of coins and notes issued by them. These come under their objective related to monetary policies. USD remains the popular coin in this regard.

Fiat Currency losing value

It is common for many more people in the market to claim that fiat currency is losing its meaning. As per the recent words of an author called J Dillian, we have a different story to tell. As we see, investing money in fiat currency is no longer a rewarding option. He talked about the coin called USD, stating that it has now gained a real intrinsic value and the fact that it is entirely away from the clutches of the commoner as the US government has its tight grip. Under the traditional currency platform, the governments also state that you must move from one USD to another. The real value of these coins and other coins are calculated with assets like gold coming into the picture. Thus, it is fair to say that fiat currency value is relative, and it has a parameter of gold in it that defines the global market in a big way. If you find too many dollars in circulation, one can see monetarists stating that they have the value that is not in the scene. You can make out that the coin often loses its meaning. At such junctures, you end up getting nothing but low-level results.

Leave a Reply